Publication

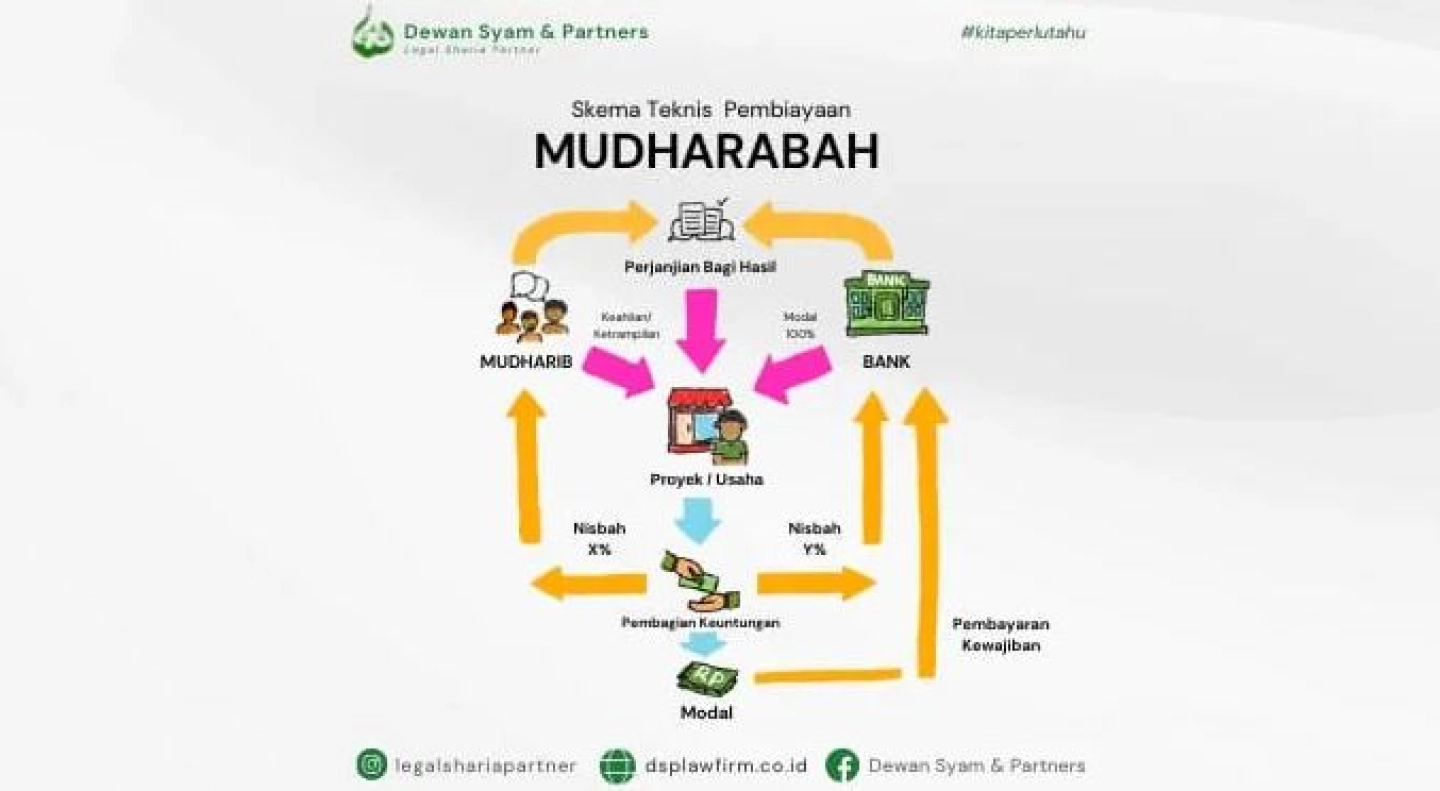

#infographic: Technical Scheme of Mudharabah Financing

#infographic: Technical Scheme of Mudharabah Financing Assalamu'alaikum Warahmatullahi Wabarakatuh

This discussion is about Mudharabah and technical financing schemes in Islamic economics.

Mudharabah according to the National Sharia Council Fatwa Number 07/DSN-MUI/IV/2000 dated April 4, 2000 concerning Mudharabah Financing (Qiradh) is a business cooperation agreement between two parties in which the first party (malik, shahib al-mal, LKS) provides all the capital, while the second party ('amil, mudharib, customer) acts as the manager, and the business profits are divided between them according to the agreement stated in the contract.

The following is also presented about the technical scheme of Mudharabah financing in the form of an infographic which can be downloaded by clicking the 'download here' button at the bottom of the article.

Hopefully it will add to the knowledge of Sharia Partners, stay motivated and healthy always and hopefully today we are all blessed by Allah SWT.

Wassalamu'alaikum Warahmatullahi Wabarakatuh

#kitaperlutahu #advokatsyariah #advokatmasakini #legalshariapartner

This discussion is about Mudharabah and technical financing schemes in Islamic economics.

Mudharabah according to the National Sharia Council Fatwa Number 07/DSN-MUI/IV/2000 dated April 4, 2000 concerning Mudharabah Financing (Qiradh) is a business cooperation agreement between two parties in which the first party (malik, shahib al-mal, LKS) provides all the capital, while the second party ('amil, mudharib, customer) acts as the manager, and the business profits are divided between them according to the agreement stated in the contract.

The following is also presented about the technical scheme of Mudharabah financing in the form of an infographic which can be downloaded by clicking the 'download here' button at the bottom of the article.

Hopefully it will add to the knowledge of Sharia Partners, stay motivated and healthy always and hopefully today we are all blessed by Allah SWT.

Wassalamu'alaikum Warahmatullahi Wabarakatuh

#kitaperlutahu #advokatsyariah #advokatmasakini #legalshariapartner

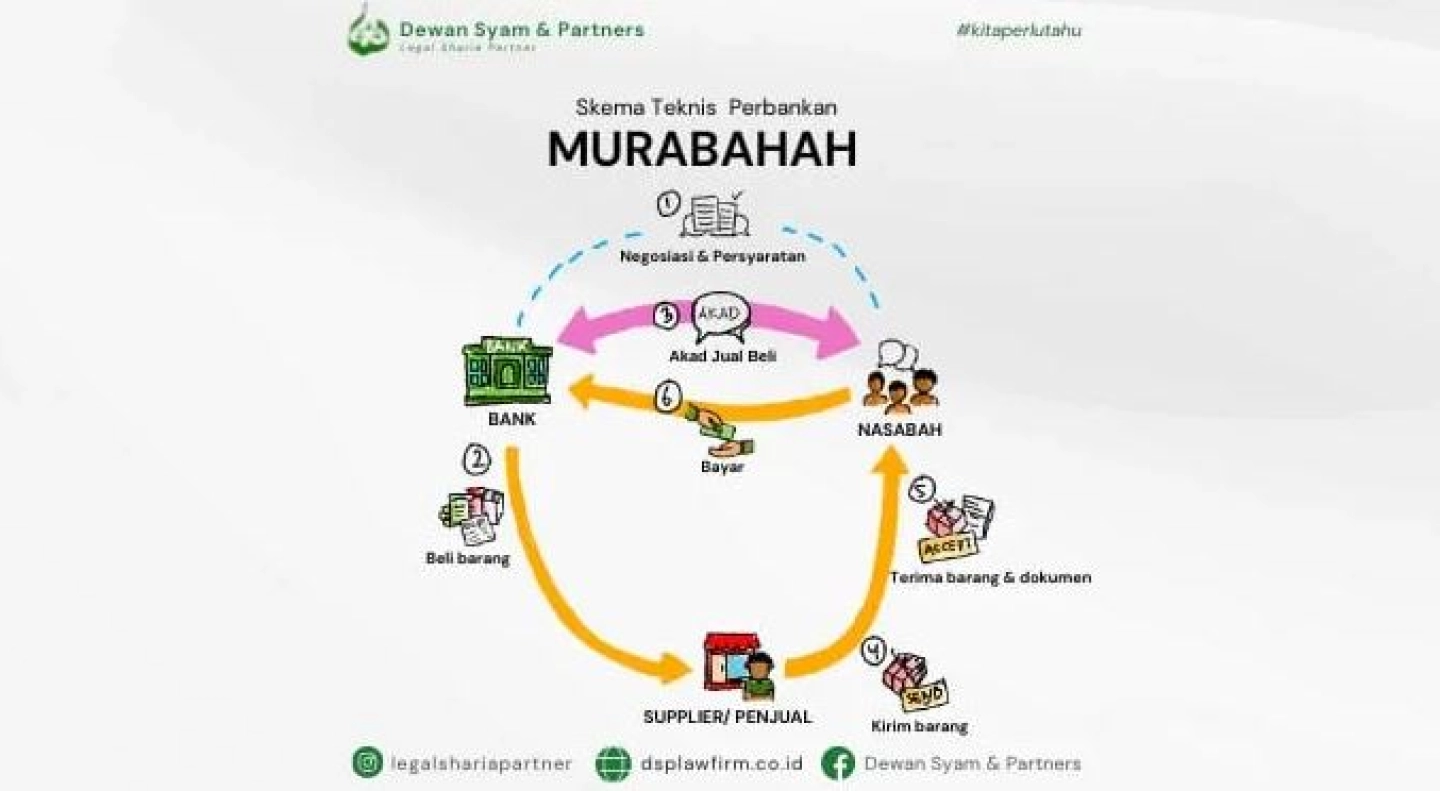

#infographic: Murabahah Banking Technical Scheme

#infographic: Murabahah Banking Technical Scheme Assalamu'alaikum Warahmatullahi Wabarakatuh

This discussion is about Murabahah and its technical banking scheme in Islamic economics.

Murabahah according to the National Sharia Council Fatwa Number 04/DSN-MUI/IV/2000 dated April 1, 2000 concerning Murabahah is selling an item by confirming its purchase price to the buyer and the buyer pays more as profit.

The following is also presented about the technical scheme of Murabahah banking in the form of an infographic which can be downloaded by clicking the 'download here' button at the bottom of the article.

Hopefully it will add to the knowledge of Sharia Partners, stay motivated and healthy always and hopefully today we are all blessed by Allah SWT.

Wassalamu'alaikum Warahmatullahi Wabarakatuh

#kitaperlutahu #advokatsyariah #advokatmasakini #legalshariapartner

This discussion is about Murabahah and its technical banking scheme in Islamic economics.

Murabahah according to the National Sharia Council Fatwa Number 04/DSN-MUI/IV/2000 dated April 1, 2000 concerning Murabahah is selling an item by confirming its purchase price to the buyer and the buyer pays more as profit.

The following is also presented about the technical scheme of Murabahah banking in the form of an infographic which can be downloaded by clicking the 'download here' button at the bottom of the article.

Hopefully it will add to the knowledge of Sharia Partners, stay motivated and healthy always and hopefully today we are all blessed by Allah SWT.

Wassalamu'alaikum Warahmatullahi Wabarakatuh

#kitaperlutahu #advokatsyariah #advokatmasakini #legalshariapartner

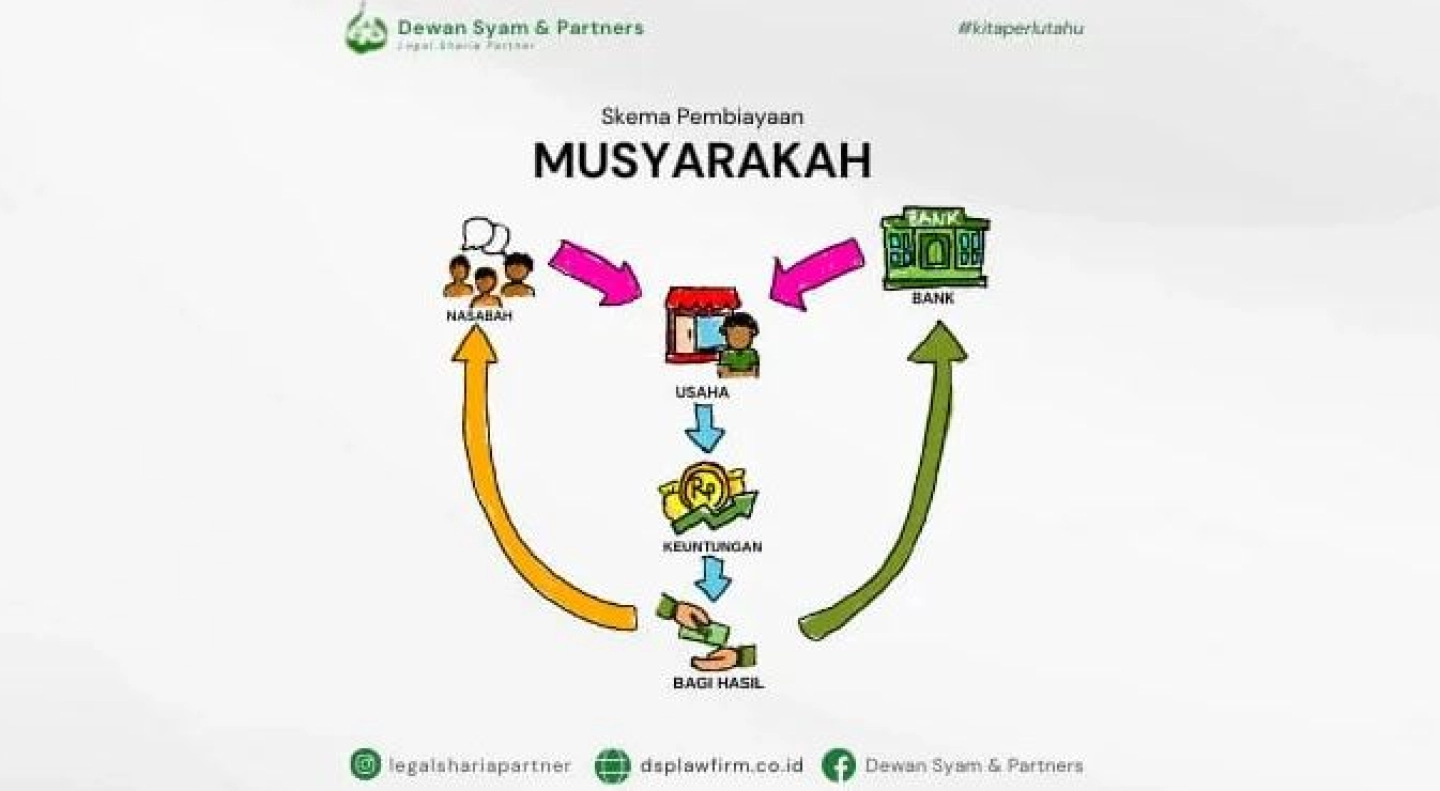

#infographic: Musyarakah Financing Scheme

#infographic: Musyarakah Financing Scheme Assalamu'alaikum Warahmatullahi Wabarakatuh

Sharia Partner... How are you doing? Do you know about Musyarakah and the financing scheme in Islamic economics? If not, here is a brief explanation.

Musyarakah is a cooperation carried out by two or more bodies or people to bind themselves in a capital and profit partnership. According to the Fatwa of the National Sharia Council Number 08/DSN-MUI/IV/2000 dated April 13, 2000 concerning Musyarakah Financing: basically all forms of muamalah may be carried out unless there is evidence that forbids it.

Of course, this is also supported by several arguments in the Qur'an so that the parties who want to bind themselves have good faith to fulfill the contracts that have been agreed upon, as mentioned in several of these verses:

"O you who believe, fulfill those contracts..." (QS. Al Maidah (5): 1)

and

"O you who believe, betray not Allah and the Messenger, nor betray the trusts entrusted to you, while you know." (QS. Al Anfal (8): 27)

The following is also presented about the Musyarakah financing process scheme in the form of an infographic which can be downloaded by clicking the 'download here' button at the bottom of the article.

Hopefully it will add to the knowledge of Sharia Partners, stay motivated and healthy always and hopefully today we are all blessed by Allah SWT.

Wassalamu'alaikum Warahmatullahi Wabarakatuh

#kitaperlutahu #advokatsyariah #advokatmasakini #legalshariapartner

Sharia Partner... How are you doing? Do you know about Musyarakah and the financing scheme in Islamic economics? If not, here is a brief explanation.

Musyarakah is a cooperation carried out by two or more bodies or people to bind themselves in a capital and profit partnership. According to the Fatwa of the National Sharia Council Number 08/DSN-MUI/IV/2000 dated April 13, 2000 concerning Musyarakah Financing: basically all forms of muamalah may be carried out unless there is evidence that forbids it.

Of course, this is also supported by several arguments in the Qur'an so that the parties who want to bind themselves have good faith to fulfill the contracts that have been agreed upon, as mentioned in several of these verses:

"O you who believe, fulfill those contracts..." (QS. Al Maidah (5): 1)

and

"O you who believe, betray not Allah and the Messenger, nor betray the trusts entrusted to you, while you know." (QS. Al Anfal (8): 27)

The following is also presented about the Musyarakah financing process scheme in the form of an infographic which can be downloaded by clicking the 'download here' button at the bottom of the article.

Hopefully it will add to the knowledge of Sharia Partners, stay motivated and healthy always and hopefully today we are all blessed by Allah SWT.

Wassalamu'alaikum Warahmatullahi Wabarakatuh

#kitaperlutahu #advokatsyariah #advokatmasakini #legalshariapartner

Implementation of the Appointment of Execution Confiscation Against the Object of Execution Confiscation in the Form of a Landing Craft Ship

Implementation of the Appointment of Execution Confiscation Against the Object of Execution Confiscation in the Form of a Landing Craft ShipOn November 09, 2021, Dewan Syam & Partners (DSP) as the Legal Counsel of Bank Syariah (Execution Applicant) participated in the implementation of the Appointment of Execution Confiscation by the Balikpapan Religious Court against the object of execution confiscation in the form of a Landing Craft Ship (LCT) located in Balikpapan City.

The appointment of the confiscation is based on an agreement between Bank Syariah (Execution Applicant) and the Customer (Execution Respondent) regarding arrears of obligations that are repaid as the best solution.

Further information can be seen on the Balikapapan Religious Court website link as follows: http://pa-balikpapan.go.id/berita/berita-terkini/618-pengadilan-agama-balikpapan-laksanakan-pengangkatan-sita-eksekusi-kapal-lct-danial-80119-09-11-2021.html

The appointment of the confiscation is based on an agreement between Bank Syariah (Execution Applicant) and the Customer (Execution Respondent) regarding arrears of obligations that are repaid as the best solution.

Further information can be seen on the Balikapapan Religious Court website link as follows: http://pa-balikpapan.go.id/berita/berita-terkini/618-pengadilan-agama-balikpapan-laksanakan-pengangkatan-sita-eksekusi-kapal-lct-danial-80119-09-11-2021.html

Implementation of the Reading of Minutes of Execution of House Emptying

Implementation of the Reading of Minutes of Execution of House Emptying Implementation of the Reading of Minutes of Execution of House Emptying

The DSP team as the attorney for the Execution Applicant with the assistance of related agencies attended the execution of the vacating of collateral objects in Cianjur, West Java. Alhamdulillah, the Execution of Collateral Objects in the form of land and buildings went smoothly.

The DSP team as the attorney for the Execution Applicant with the assistance of related agencies attended the execution of the vacating of collateral objects in Cianjur, West Java. Alhamdulillah, the Execution of Collateral Objects in the form of land and buildings went smoothly.

Implementation of Creditors and Debtor Meetings in PKPUS (Postponement of Temporary Debt Payment Obligations) at the Central Jakarta Commercial Court

Implementation of Creditors and Debtor Meetings in PKPUS (Postponement of Temporary Debt Payment Obligations) at the Central Jakarta Commercial CourtAlhamdulillah, the DSP Team (Mr. Syamsul Huda, S.H., M.E.) was appointed as the Executive for Suspension of Temporary Debt Payment Obligations (in PKPUS) and it has ended with peace.

Execution of Confiscation of Execution of Mortgage Deed Mortgage Collateral Objects in the Form of 3 Ships in the Balikpapan Religious Court

Execution of Confiscation of Execution of Mortgage Deed Mortgage Collateral Objects in the Form of 3 Ships in the Balikpapan Religious Court Alhamdulillah, on June 25, 2020, Dewan Syam & Partners Law Firm as the attorney from one of the Sharia Banks in Indonesia as an Execution Applicant in the Balikpapan Religious Court has carried out a seizure of the grosse mortgage deed guarantee for 3 ships for the acts of Default carried out by the Respondent Execution in the Agreement Murabahah Contract Financing.

The execution of the confiscation carried out went smoothly with the co-operative attitude of the Respondent Execution and was accompanied by 54 personnel of the Republic of Indonesia State Police of the East Kalimantan Region of Balikpapan City.

https://pa-balikpapan.go.id/berita/berita-terkini/395-pengkamah-agama-balikpapan-sita-3-buah-kapal-motor-jamininan-hypotik-25-06-2020.html

The execution of the confiscation carried out went smoothly with the co-operative attitude of the Respondent Execution and was accompanied by 54 personnel of the Republic of Indonesia State Police of the East Kalimantan Region of Balikpapan City.

https://pa-balikpapan.go.id/berita/berita-terkini/395-pengkamah-agama-balikpapan-sita-3-buah-kapal-motor-jamininan-hypotik-25-06-2020.html

Implementation of the Decision of the National Sharia Arbitration Board at the Religious Court of Madiun City

Implementation of the Decision of the National Sharia Arbitration Board at the Religious Court of Madiun City DSP Law Firm as the recipient of authority from the Sharia Financial Institution has submitted an application for the resolution of Islamic economic disputes at the National Sharia Arbitration Board (Basyarnas) for the act of Ingkar Promise (Default) Financing Facility under the Murabahah Akad scheme.

Madiun City Religious Court based on the origin of 13 paragraph (2) of the Republic of Indonesia Supreme Court Regulation No. 14 of 2016 concerning Procedures for Settling Sharia Economic Cases, has carried out the Basyarnas Decision to confiscate the execution of the financial guarantee objects included in the Amar Basyarnas Decision.

Madiun City Religious Court based on the origin of 13 paragraph (2) of the Republic of Indonesia Supreme Court Regulation No. 14 of 2016 concerning Procedures for Settling Sharia Economic Cases, has carried out the Basyarnas Decision to confiscate the execution of the financial guarantee objects included in the Amar Basyarnas Decision.

IJTIMA'SANAWI AND DSN-MUI SEMILOCA 2019

IJTIMA'SANAWI AND DSN-MUI SEMILOCA 2019 Alhamdulillah, I was able to attend and be one of the speakers at the 2019 Ijtima'Sanawi And Semiloka DSN-MUI seminar at Aston Bogor Hotel.

In this seminar and workshop there were a number of points conveyed by the DSP Team as well as representatives of the Mahasantri Pesantren PLMM DSN-MUI as Legal Practitioners who were directly involved in Islamic economic disputes, namely the need for additional roles for DPS Members (Sharia Supervisory Board) to mediate before the dispute enter the realm of litigation.

what is meant by the mediator is that DPS as a person who is considered to be very knowledgeable in the science of muamalah fiqh should be able to become a mediator between the financial institutions and partners / customers. this is important because all this time, the resolution of Islamic economic disputes at the mediation stage at the Religious Courts is still at the formality stage, not touching the core problems of the Sharia Agreement.

In this seminar and workshop there were a number of points conveyed by the DSP Team as well as representatives of the Mahasantri Pesantren PLMM DSN-MUI as Legal Practitioners who were directly involved in Islamic economic disputes, namely the need for additional roles for DPS Members (Sharia Supervisory Board) to mediate before the dispute enter the realm of litigation.

what is meant by the mediator is that DPS as a person who is considered to be very knowledgeable in the science of muamalah fiqh should be able to become a mediator between the financial institutions and partners / customers. this is important because all this time, the resolution of Islamic economic disputes at the mediation stage at the Religious Courts is still at the formality stage, not touching the core problems of the Sharia Agreement.

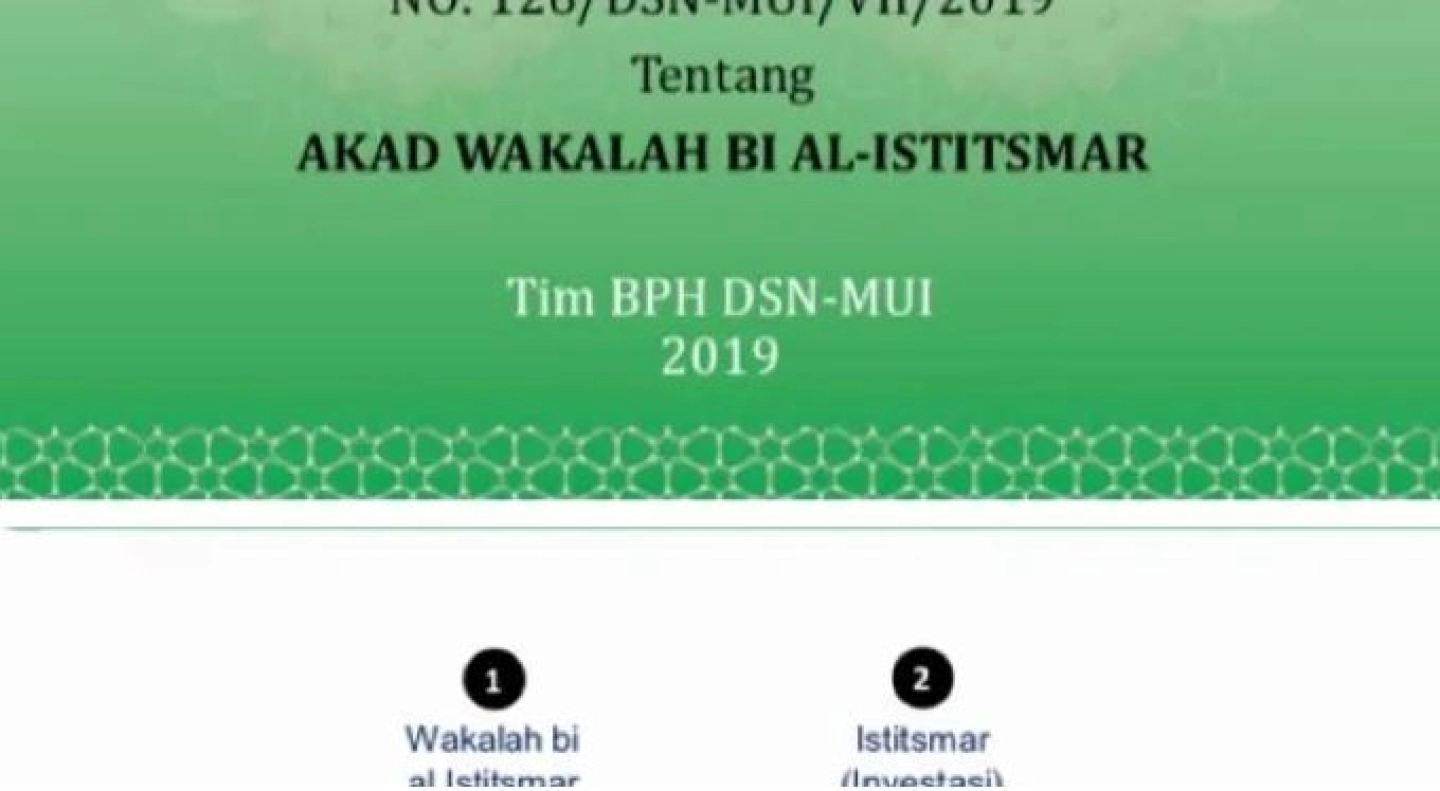

Akkad Investment Agency

Akkad Investment Agency MUI National Sharia Board has issued a new contract scheme through Fatwa Number.126 / DSN-MUI / VII / 2019 Concerning the Wakalah Bi Al-Istitsmar Agreement.

Wakalah Bi Al-Istitsmar is a wakalah contract or power to invest Muwakkil capital both in return (Wakalah bi al-ujrah) or without compensation (wakalah bi ghairi al-ujrah).

The Wakalah Bi Al-Istitsmar scheme can be briefly understood as follows:

1. Investor (Muwakkil) gives wakalah (power) to the Deputy to invest (manage and develop) the funds (Akad Wakalah bi al-istitsmar).

2. Representatives invest Muwakkil's funds in a variety of contracts that are in accordance with sharia principles.

3. Investment can produce results or risks.

4. All results and risks become Muwakkil's rights and burdens.

5. Returns of Investment Funds to Investors (Muwakkil).

In sharia business practices, the Akalah Wakalah Bi Al-Istitsmar can be applied to investment business practices for sharia mutual funds, as well as for new business entities namely sharia fintech, where the owner of the fund (investor / muwakkil) can give wakalah to the operating company to manage their funds in accordance with sharia .

However, the implementation of the Bi Al-Istitsmar Wakalah Agreement is also inseparable from other Fatwas as in the case of the Bi Al-Istitsmar Wakalah Agreement conducted by granting Ujrah, then this must refer to the Wakalah Bi-al Ujrah contract.

Wakalah Bi Al-Istitsmar is a wakalah contract or power to invest Muwakkil capital both in return (Wakalah bi al-ujrah) or without compensation (wakalah bi ghairi al-ujrah).

The Wakalah Bi Al-Istitsmar scheme can be briefly understood as follows:

1. Investor (Muwakkil) gives wakalah (power) to the Deputy to invest (manage and develop) the funds (Akad Wakalah bi al-istitsmar).

2. Representatives invest Muwakkil's funds in a variety of contracts that are in accordance with sharia principles.

3. Investment can produce results or risks.

4. All results and risks become Muwakkil's rights and burdens.

5. Returns of Investment Funds to Investors (Muwakkil).

In sharia business practices, the Akalah Wakalah Bi Al-Istitsmar can be applied to investment business practices for sharia mutual funds, as well as for new business entities namely sharia fintech, where the owner of the fund (investor / muwakkil) can give wakalah to the operating company to manage their funds in accordance with sharia .

However, the implementation of the Bi Al-Istitsmar Wakalah Agreement is also inseparable from other Fatwas as in the case of the Bi Al-Istitsmar Wakalah Agreement conducted by granting Ujrah, then this must refer to the Wakalah Bi-al Ujrah contract.

Execution of Islamic Financing Guarantee Objects

Execution of Islamic Financing Guarantee Objects Sita Execution is a series of the process of execution of Mortgage Rights that have been requested by us for the benefit of Islamic Financial Institutions.

This execution process is a crucial point because it was approved by legal consultants to take the wrong step, then the resistance process will also be carried out by the Customer of the default which is not carried out by its assets.

DSP always mitigates risks before executing executions in the Religious Courts, risk mitigation is carried out in accordance with their respective criteria such as each such as Murabaha, increasing Musyarakah financing, and improving Mudharabah, all of which must be carried out in order to be executed properly.

This execution process is a crucial point because it was approved by legal consultants to take the wrong step, then the resistance process will also be carried out by the Customer of the default which is not carried out by its assets.

DSP always mitigates risks before executing executions in the Religious Courts, risk mitigation is carried out in accordance with their respective criteria such as each such as Murabaha, increasing Musyarakah financing, and improving Mudharabah, all of which must be carried out in order to be executed properly.

Can the Restructuring of Sharia Financing Agreements

Can Cancel Mortgage Rights?

Author: M.Akhbar Dewani, S.H., M.H.

Can Cancel Mortgage Rights?

Author: M.Akhbar Dewani, S.H., M.H.

Credit/financing restructuring in the banking industry is a natural thing, where the choice is a solution so that the financing carried out still has NPLs that are credible enough for the bank, in addition to the bank's efforts in order to help customers to settle their obligations (Article 1 paragraph 6 Pojk No; 12 /Pojk.03/2015). In banking practice, restructuring activities are of course followed by a new agreement followed by the making of a new agreement or additional agreement (addendum), with different clauses and agreements.

In conventional banks, this action is not a new and crucial legal issue considering that conventional banks do not have various contract products, so that when restructuring occurs, the choice of binding used by the parties is still the same as the original contract. However, it can be different with Islamic banking, which has many choices of contracts that can be determined in accordance with the wishes and agreements of the parties made at the time of the restructuring contract.

When this restructuring occurs, it will certainly affect all legal instruments that apply to the financing guarantee, without exception to the Mortgage Rights (HT).

Accesoir Nature of Agreement in Mortgage

HT must follow the main financing agreement, so that the guarantee nature of the property can be used for debts that have been issued or will exist. The granting of HT is preceded by a promise to grant HT as collateral for the repayment of certain debts, which is stated in and is an inseparable part of the relevant debt agreement or other agreements that give rise to the debt.

In accordance with the nature of accessoir HT, the granting must be an ancillary of the main agreement, namely the agreement that gives rise to the legal relationship of debt and credit guaranteed repayment. The agreement that gives rise to this debt and credit relationship can be made by deed under hand or must be made by authentic deed, depending on the legal provisions governing the material of the agreement. (Article 10 paragraph 1 of Law No. 4 of 1996).

Debts that are guaranteed to be repaid by HT can be debts that have existed or that have been promised with a certain amount or an amount that at the time the application for execution of HT is submitted can be determined based on the debt and credit agreement or other agreements that give rise to the debt and credit relationship concerned. (Article 3 UUHT Law No. 4 of 1996).

The existence of HT depends on the existence of receivables guaranteed repayment. If the receivable is erased due to repayment or other causes, automatically HT concerned becomes erased as well. (Article 18 paragraph 1 of Law No. 4 of 1996).

As a manifestation of legal certainty, the accesoir nature is also strictly practiced in debt and credit agreements or other agreements, which are guaranteed repayment. In the event that the receivable in question passes to another creditor, the HT that guarantees it, by law, also passes to that creditor.

Because the Hak Tanggungan by its nature is an accessory to a certain receivable, which is based on a debt and credit agreement or other agreement, its birth and existence are determined by the existence of the receivable guaranteed by its repayment. In the event that the receivable in question is transferred to another creditor, the Mortgage Right that guarantees it, by law, also transfers to that creditor. The recording of the transfer of the Mortgage Right does not require a PPAT deed, but is sufficiently based on the deed of transfer of the secured receivables. Without neglecting legal certainty for the parties concerned, the simplicity of administration of the registration of Mortgage Rights, apart from the transfer and extinguishment of secured receivables, also appears in the extinguishment of the right due to other causes, namely because it is released by the creditor concerned, clearing the object of HT based on the determination of ranking by the Chairman of the District Court, and the extinguishment of land rights that are used as collateral. (general explanation point 8 of Law No. 4 of 1996).

These provisions are intended to show that in addition to the accesoir nature owned by HT is always attached, HT made must also specifically and in detail refer to the debt indicated in a particular agreement, to avoid ambiguous meaning and multiple interpretations that can result in the blurring of the HT itself.

Between Addendum and New Agreement

In the rules of civil law, it is determined that every agreement is valid like a law for the parties who agree to the agreement (1338 KUHPer). While in banking practice there are many kinds of terms related to agreements such as addendum agreements, amendments, changes to agreements, principal agreements and accessories agreements, and extension of agreements / contracts. The large Indonesian dictionary defines that what is meant by an addendum agreement is an additional volume (to a book); attachment, provision or additional article, for example in a deed. Generally, this addendum is used when there are additions or attachments to the main agreement and is an integral part of the main agreement. Because of its changeable nature in order to keep up with dynamic business developments or intended to change some of the provisions of the main agreement, while still agreeing on the main clauses in the main agreement.

In the Islamic banking industry, addendum agreements are usually made when financing restructuring, debt renewal (novation), subrogration, cessie, or in the condition of placing investment funds to partners in the form of agreements with channeling, servicing or executing schemes. Meanwhile, an amendment agreement is an agreement that agrees to change the initial agreement, either partially or completely, on the basis of which the rights and obligations of the parties also change.

Of course, as long as the agreement meets the objective and subjective requirements as specified in Article 1320 of the Civil Code, the agreement still has limited binding independence on the agreement, including when the agreement is based on other agreements, for example. Conversion of Agreements in Financing Restructuring

Regarding the restructuring of the Banten High Court decision Number 118 / PDT / 2015 / PT BTN provides a reference to sharia industry practitioners in Indonesia that, the latest contract resulting from restructuring cannot be used as a basis in an effort to carry out execution, with the fact that the first contract is murabahah and the restructuring contract is a musyarakah contract.

DSN MUI Fatwa NO: 04/DSN-MUI/IV/2000 states that "sharia banks need to have murabahah facilities for those who need them, which is selling an item by confirming its purchase price to the buyer and the buyer pays more as profit". While the DSN MUI fatwa NO: 08/DSN-MUI/IV/2000 concerning musyarakah determines that financing is based on a cooperation contract between two or more parties for a certain business, in which each party contributes funds with the provision that profits and risks will be borne together in accordance with the agreement. Of course, in principle, HT, which was originally used to guarantee financing on the basis of "buying and selling", has changed to guarantee financing on the basis of a "joint venture" contract, which has different sharia objectives. Of course, the difference in contracts in this restructuring is very possible considering that there are at least 5 different basic contract schemes in Islamic banking: first, profit-sharing transactions in the form of mudharabah and musyarakah; second, leasing transactions in the form of ijarah or lease purchase, in the form of ijarah muntahiyah bit tamlik; third, sale and purchase transactions in the form of murabahah, salam and istishna' receivables; fourth, lending and borrowing transactions in the form of qardh receivables; and fifth, service leasing transactions in the form of ijarah for multi-service transactions.

Therefore, for example, HT intended to guarantee debt with a murabahah contract only applies to murabahah debt, so the consequences do not apply, for example, to a musyarakah restructuring contract even though it is still in one financing. Even so, this still does not erase the debts of customers who owe banks.

In the event that the bank wants HT to also apply to the original principal contract and the restructuring contract, then by law based on the existing HT provisions it is also required to register HT at the land office in order to guarantee the debt based on the agreement before and after the restructuring.

In conventional banks, this action is not a new and crucial legal issue considering that conventional banks do not have various contract products, so that when restructuring occurs, the choice of binding used by the parties is still the same as the original contract. However, it can be different with Islamic banking, which has many choices of contracts that can be determined in accordance with the wishes and agreements of the parties made at the time of the restructuring contract.

When this restructuring occurs, it will certainly affect all legal instruments that apply to the financing guarantee, without exception to the Mortgage Rights (HT).

Accesoir Nature of Agreement in Mortgage

HT must follow the main financing agreement, so that the guarantee nature of the property can be used for debts that have been issued or will exist. The granting of HT is preceded by a promise to grant HT as collateral for the repayment of certain debts, which is stated in and is an inseparable part of the relevant debt agreement or other agreements that give rise to the debt.

In accordance with the nature of accessoir HT, the granting must be an ancillary of the main agreement, namely the agreement that gives rise to the legal relationship of debt and credit guaranteed repayment. The agreement that gives rise to this debt and credit relationship can be made by deed under hand or must be made by authentic deed, depending on the legal provisions governing the material of the agreement. (Article 10 paragraph 1 of Law No. 4 of 1996).

Debts that are guaranteed to be repaid by HT can be debts that have existed or that have been promised with a certain amount or an amount that at the time the application for execution of HT is submitted can be determined based on the debt and credit agreement or other agreements that give rise to the debt and credit relationship concerned. (Article 3 UUHT Law No. 4 of 1996).

The existence of HT depends on the existence of receivables guaranteed repayment. If the receivable is erased due to repayment or other causes, automatically HT concerned becomes erased as well. (Article 18 paragraph 1 of Law No. 4 of 1996).

As a manifestation of legal certainty, the accesoir nature is also strictly practiced in debt and credit agreements or other agreements, which are guaranteed repayment. In the event that the receivable in question passes to another creditor, the HT that guarantees it, by law, also passes to that creditor.

Because the Hak Tanggungan by its nature is an accessory to a certain receivable, which is based on a debt and credit agreement or other agreement, its birth and existence are determined by the existence of the receivable guaranteed by its repayment. In the event that the receivable in question is transferred to another creditor, the Mortgage Right that guarantees it, by law, also transfers to that creditor. The recording of the transfer of the Mortgage Right does not require a PPAT deed, but is sufficiently based on the deed of transfer of the secured receivables. Without neglecting legal certainty for the parties concerned, the simplicity of administration of the registration of Mortgage Rights, apart from the transfer and extinguishment of secured receivables, also appears in the extinguishment of the right due to other causes, namely because it is released by the creditor concerned, clearing the object of HT based on the determination of ranking by the Chairman of the District Court, and the extinguishment of land rights that are used as collateral. (general explanation point 8 of Law No. 4 of 1996).

These provisions are intended to show that in addition to the accesoir nature owned by HT is always attached, HT made must also specifically and in detail refer to the debt indicated in a particular agreement, to avoid ambiguous meaning and multiple interpretations that can result in the blurring of the HT itself.

Between Addendum and New Agreement

In the rules of civil law, it is determined that every agreement is valid like a law for the parties who agree to the agreement (1338 KUHPer). While in banking practice there are many kinds of terms related to agreements such as addendum agreements, amendments, changes to agreements, principal agreements and accessories agreements, and extension of agreements / contracts. The large Indonesian dictionary defines that what is meant by an addendum agreement is an additional volume (to a book); attachment, provision or additional article, for example in a deed. Generally, this addendum is used when there are additions or attachments to the main agreement and is an integral part of the main agreement. Because of its changeable nature in order to keep up with dynamic business developments or intended to change some of the provisions of the main agreement, while still agreeing on the main clauses in the main agreement.

In the Islamic banking industry, addendum agreements are usually made when financing restructuring, debt renewal (novation), subrogration, cessie, or in the condition of placing investment funds to partners in the form of agreements with channeling, servicing or executing schemes. Meanwhile, an amendment agreement is an agreement that agrees to change the initial agreement, either partially or completely, on the basis of which the rights and obligations of the parties also change.

Of course, as long as the agreement meets the objective and subjective requirements as specified in Article 1320 of the Civil Code, the agreement still has limited binding independence on the agreement, including when the agreement is based on other agreements, for example. Conversion of Agreements in Financing Restructuring

Regarding the restructuring of the Banten High Court decision Number 118 / PDT / 2015 / PT BTN provides a reference to sharia industry practitioners in Indonesia that, the latest contract resulting from restructuring cannot be used as a basis in an effort to carry out execution, with the fact that the first contract is murabahah and the restructuring contract is a musyarakah contract.

DSN MUI Fatwa NO: 04/DSN-MUI/IV/2000 states that "sharia banks need to have murabahah facilities for those who need them, which is selling an item by confirming its purchase price to the buyer and the buyer pays more as profit". While the DSN MUI fatwa NO: 08/DSN-MUI/IV/2000 concerning musyarakah determines that financing is based on a cooperation contract between two or more parties for a certain business, in which each party contributes funds with the provision that profits and risks will be borne together in accordance with the agreement. Of course, in principle, HT, which was originally used to guarantee financing on the basis of "buying and selling", has changed to guarantee financing on the basis of a "joint venture" contract, which has different sharia objectives. Of course, the difference in contracts in this restructuring is very possible considering that there are at least 5 different basic contract schemes in Islamic banking: first, profit-sharing transactions in the form of mudharabah and musyarakah; second, leasing transactions in the form of ijarah or lease purchase, in the form of ijarah muntahiyah bit tamlik; third, sale and purchase transactions in the form of murabahah, salam and istishna' receivables; fourth, lending and borrowing transactions in the form of qardh receivables; and fifth, service leasing transactions in the form of ijarah for multi-service transactions.

Therefore, for example, HT intended to guarantee debt with a murabahah contract only applies to murabahah debt, so the consequences do not apply, for example, to a musyarakah restructuring contract even though it is still in one financing. Even so, this still does not erase the debts of customers who owe banks.

In the event that the bank wants HT to also apply to the original principal contract and the restructuring contract, then by law based on the existing HT provisions it is also required to register HT at the land office in order to guarantee the debt based on the agreement before and after the restructuring.