Publication

Implementation of Focus Group Discussion (FGD) DSP with Bank Maybank Indonesia

Implementation of Focus Group Discussion (FGD) DSP with Bank Maybank Indonesia Dewan Syam & Partners Law Firm (DSP Law Firm) has carried out the Focus Group Discussion (FGD) with PT Bank Maybank Indonesia, Tbk with the topic of discussion, namely the legal issue in the problematic financing on Islamic financial institutions.

Alhamdulillah, the implementation of the FGD was running smoothly by being attended by the DSP Law Firm Team and PT Bank Maybank Indonesia's Litigation Work Unit, Tbk. DSP Law Firm as a law office that focuses on sharia economic activities both litigation and non -litigation on the occasion shared experiences and insights with the people of Bank Maybank Indonesia.

Among the materials DSP Law Firm shared, namely the discussion of the causes of problem financing and various exposure of litigation cases handled by the DSP Law Firm both in the Religious Court and in the National Sharia Arbitration Agency (Basyarnas).

For the implementation of this event, hopefully it can increase knowledge and make a positive contribution to solutions to problems to Islamic economic activities in Indonesia.

Alhamdulillah, the implementation of the FGD was running smoothly by being attended by the DSP Law Firm Team and PT Bank Maybank Indonesia's Litigation Work Unit, Tbk. DSP Law Firm as a law office that focuses on sharia economic activities both litigation and non -litigation on the occasion shared experiences and insights with the people of Bank Maybank Indonesia.

Among the materials DSP Law Firm shared, namely the discussion of the causes of problem financing and various exposure of litigation cases handled by the DSP Law Firm both in the Religious Court and in the National Sharia Arbitration Agency (Basyarnas).

For the implementation of this event, hopefully it can increase knowledge and make a positive contribution to solutions to problems to Islamic economic activities in Indonesia.

Proof of a letter at the trial of the IKNB Fintech Peer-to-Peer Lending Sharia dispute

Proof of a letter at the trial of the IKNB Fintech Peer-to-Peer Lending Sharia disputeIn general, the proof of the letter in front of the trial, the attorney offered to the council of two documents namely: (1) the original document of the proof of the letter; (2) Photocopy of the letter document that has been attached to the stamp (legalized). But this is not possible if the principal is the IKNB fintech peer-to-peer lending sharia.

Judges in the Religious Court as a court in the sharia economic dispute are still unfamiliar in trying the case related to the sharia fintech, so it is necessary to ensure the evidence that is only in the form of a photocopy of the signature of the contract also writing the name of the party (not a signature in general), in addition Judge Evidence from IT activities such as signatures should be in the form of barcodes (such as barcodes in birth certificates or family cards).

The DSP Law Firm Team as the attorney of one of the sharia fintechs in Indonesia has submitted proof of letter by giving confidence to the Panel of Judges of the Central Jakarta Religious Court, that the original proof of letter is indeed a print out of the system (platform), so it is impossible to be shown in physical form in general (such as wet signatures on the seal). The judge's confidence in the evidence of one of them is to present a team from fintech sharia to open the application directly and download directly from the application used by the fintech sharia company (as the organizer) and partners (financing recipients).

The proof of the letter shown through the application in sequence include:

1. Wakalah Bi Al Ujrah contract between organizers and prospective recipients of funders (borrower).

2. Kafalah contract from the recipient of financing (borrower).

3. Wakalah contract from shohibul maal (lender) to the organizer.

4. Murabahah contract between organizers and financing recipients.

The attorney representing IKNB fintech sharia must be able to translate maqashid from each of these contracts, because the main problem is basically in the murabahah contract, but other contracts cannot be released because it is a series of peer-to-peer lending activities with Sharia principles themselves.

We DSP Law Firm (Legal Sharia Partner) is very open to discussions with the perpetrators of the Syariah Fintech IKNB for legal risk mitigation on the Syariah fintech peer-to-peer transaction. May Allah SWT give strength, health, convenience and guidance for all of us in guarding the Islamic economy in Indonesia. Amen!

Judges in the Religious Court as a court in the sharia economic dispute are still unfamiliar in trying the case related to the sharia fintech, so it is necessary to ensure the evidence that is only in the form of a photocopy of the signature of the contract also writing the name of the party (not a signature in general), in addition Judge Evidence from IT activities such as signatures should be in the form of barcodes (such as barcodes in birth certificates or family cards).

The DSP Law Firm Team as the attorney of one of the sharia fintechs in Indonesia has submitted proof of letter by giving confidence to the Panel of Judges of the Central Jakarta Religious Court, that the original proof of letter is indeed a print out of the system (platform), so it is impossible to be shown in physical form in general (such as wet signatures on the seal). The judge's confidence in the evidence of one of them is to present a team from fintech sharia to open the application directly and download directly from the application used by the fintech sharia company (as the organizer) and partners (financing recipients).

The proof of the letter shown through the application in sequence include:

1. Wakalah Bi Al Ujrah contract between organizers and prospective recipients of funders (borrower).

2. Kafalah contract from the recipient of financing (borrower).

3. Wakalah contract from shohibul maal (lender) to the organizer.

4. Murabahah contract between organizers and financing recipients.

The attorney representing IKNB fintech sharia must be able to translate maqashid from each of these contracts, because the main problem is basically in the murabahah contract, but other contracts cannot be released because it is a series of peer-to-peer lending activities with Sharia principles themselves.

We DSP Law Firm (Legal Sharia Partner) is very open to discussions with the perpetrators of the Syariah Fintech IKNB for legal risk mitigation on the Syariah fintech peer-to-peer transaction. May Allah SWT give strength, health, convenience and guidance for all of us in guarding the Islamic economy in Indonesia. Amen!

Execution Confiscation of Peer-to-peer Landing (Fintech Sharia) Customer-Owned Assets by the West Jakarta Religious Court

Execution Confiscation of Peer-to-peer Landing (Fintech Sharia) Customer-Owned Assets by the West Jakarta Religious CourtOn Tuesday, March 14 2023, Alhamdulillah, the West Jakarta Religious Court has placed a Collateral Seizure (Conservatoir Beslaag) for a delegation from the Cibinong Religious Court for immovable property belonging to Defendant II (Customer Financing Guarantor) in the form of an Apartment object located in Kelapa Dua Village , Kebon Jeruk District, West Jakarta City.

The execution of the confiscation was attended by the Dewan Syam & Partners Law Firm Team as the Plaintiff's Attorney, Bailiff at the West Jakarta Religious Court, Plt. Secretary of Kelapa Dua Village, witnesses, as well as local Babinsa and Bhabinkamtibmas officials, without the presence of the Defendant.

Most of the financing with peer to peer landing carried out by Financial Technology (Fintech) companies, even with Financing Contract schemes with Sharia Principles, does not include a specific collateral object, so that in the process of recovering losses, Islamic fintech companies must trace the assets of the guarantor (kafiil) or the beneficiary. Financing first then attract guarantor assets (kafiil) in lawsuits in the Religious Courts.

The execution of the confiscation was attended by the Dewan Syam & Partners Law Firm Team as the Plaintiff's Attorney, Bailiff at the West Jakarta Religious Court, Plt. Secretary of Kelapa Dua Village, witnesses, as well as local Babinsa and Bhabinkamtibmas officials, without the presence of the Defendant.

Most of the financing with peer to peer landing carried out by Financial Technology (Fintech) companies, even with Financing Contract schemes with Sharia Principles, does not include a specific collateral object, so that in the process of recovering losses, Islamic fintech companies must trace the assets of the guarantor (kafiil) or the beneficiary. Financing first then attract guarantor assets (kafiil) in lawsuits in the Religious Courts.

DSP Law Firm again won an award as In-house Counsel Choice 2022: Most Recommended Law Firm

DSP Law Firm again won an award as In-house Counsel Choice 2022: Most Recommended Law FirmAssalamu’alaikum Warahmatullahi Wabarakatuh,

Alhamdulillah, we first pray and thank God for Allah SWT for his will of the Law Council of the Sham Council & Partners (Legal Sharia Partner) again won an award as In-house Counsel Choice 2022: Most Recommended Law Firm given by Hukumonline as the organizer.

In addition, on this occasion the award was also given to the Managing Partner of the Syam & Partners Council, Mr. Syamsul Huda who won the Recommended Lawyers Hukumonline's in House Counsel Choice 2022.

For this achievement, we thank the sharia partners for always giving good trust and cooperation to the Sham & Partners council. May Allah SWT give His blessings and grace to all of us. Amen.

Wassalamualaikum warahmatullahi wabarakatuh

Alhamdulillah, we first pray and thank God for Allah SWT for his will of the Law Council of the Sham Council & Partners (Legal Sharia Partner) again won an award as In-house Counsel Choice 2022: Most Recommended Law Firm given by Hukumonline as the organizer.

In addition, on this occasion the award was also given to the Managing Partner of the Syam & Partners Council, Mr. Syamsul Huda who won the Recommended Lawyers Hukumonline's in House Counsel Choice 2022.

For this achievement, we thank the sharia partners for always giving good trust and cooperation to the Sham & Partners council. May Allah SWT give His blessings and grace to all of us. Amen.

Wassalamualaikum warahmatullahi wabarakatuh

Peace in the implementation of the seizure of the execution of objects in the form of SPOB ships by PA Gedong Tataan

Peace in the implementation of the seizure of the execution of objects in the form of SPOB ships by PA Gedong TataanOn December 9, 2022 at the waters of Mutun Beach, Pesawaran Regency, Lampung, Alhamdulillah, the appointment of the execution seizure of the execution object in the form of a SPOB ship carried out by the Gedong Tataan Religious Court.

The appointment of this execution confiscation is based on the results of an agreement between the execution applicant and the execution of the execution for the sale of voluntary execution objects that have prospective buyers. Voluntary sales are expected so that the object of execution gets a high selling value.

Furthermore, it can be seen on the PA Gedong Tataan website with the following link:

https://www.pa-gedongtataan.go.id/bantuan/arsip-berita/1060-pa-gedong-tataan-laksanakan-pengangkatan-sita-eksekusi-terhadap-kapal-motor.html

The appointment of this execution confiscation is based on the results of an agreement between the execution applicant and the execution of the execution for the sale of voluntary execution objects that have prospective buyers. Voluntary sales are expected so that the object of execution gets a high selling value.

Furthermore, it can be seen on the PA Gedong Tataan website with the following link:

https://www.pa-gedongtataan.go.id/bantuan/arsip-berita/1060-pa-gedong-tataan-laksanakan-pengangkatan-sita-eksekusi-terhadap-kapal-motor.html

Dewan Syam & Partners Law Firm won the Hukumonline's Top 100 Indonesian Law Firms 2022

Dewan Syam & Partners Law Firm won the Hukumonline's Top 100 Indonesian Law Firms 2022Alhamdulillah with full gratitude to Allah SWT, Law Firm of the Sham Council & Partners succeeded in achieving Hukumonline's Top 100 Indonesian Law Firms 2022. For this achievement we would like to thank online law as the organizer and to the partners or clients who have given their trust to DSP Law Firm.

Hopefully this achievement will be a reference and enthusiasm for DSP Law Firm to maintain and improve legal services to partners/clients.

The following is an online legal interview video link with Managing Partner DSP Law Firm: https://youtu.be/-S721EHOAOM

Hopefully this achievement will be a reference and enthusiasm for DSP Law Firm to maintain and improve legal services to partners/clients.

The following is an online legal interview video link with Managing Partner DSP Law Firm: https://youtu.be/-S721EHOAOM

Implementation of a seizure of execution of the object of a mortgage execution in the form of a Motor Boat (SPOB)

Implementation of a seizure of execution of the object of a mortgage execution in the form of a Motor Boat (SPOB) On August 29, 2022, Alhamdulillah, a confiscation of execution was carried out on the object of execution in the form of a SPOB (Self Propelled Oil Barge) motorcycle by the Gedong Tataan Religious Court on the request for the execution of the hypotek proposed by the Dewan Syam & Partners Law Firm as the Power of the Islamic Bank to the Customer of the Bank Customer Sharia who has committed an act of breaking the promise of financing with the type of musyarakah and murabaha contracts.

The implementation of the execution seizure went smoothly with the execution of the execution applicant, Chairman of PA Gedong Tataan, PA Gedong Tataan, PA Gedong Tataan, Witnesses, village officials, and local police officers, without being attended by the request of the execution both principles and their power.

For more information, it can be seen on the PA Gedong Tataan website with the following link:

https://www.pa-gedongtataan.go.id/bantuan/arsip-berita/1003-pertama-kalinya-pa-gedong-tataan-sukses-melaksanakan-sita-eksekusi-hak-hipotek-kapal-motor.html

The implementation of the execution seizure went smoothly with the execution of the execution applicant, Chairman of PA Gedong Tataan, PA Gedong Tataan, PA Gedong Tataan, Witnesses, village officials, and local police officers, without being attended by the request of the execution both principles and their power.

For more information, it can be seen on the PA Gedong Tataan website with the following link:

https://www.pa-gedongtataan.go.id/bantuan/arsip-berita/1003-pertama-kalinya-pa-gedong-tataan-sukses-melaksanakan-sita-eksekusi-hak-hipotek-kapal-motor.html

The PMH lawsuit that canceled the Al-Murabahah financing contract (Sharia contract) at the North Jakarta District Court was annulled by the Supreme Court

The PMH lawsuit that canceled the Al-Murabahah financing contract (Sharia contract) at the North Jakarta District Court was annulled by the Supreme CourtOn September 9, 2021, the Supreme Court of the Republic of Indonesia based on Decision Number 497 PK/PDT/2021 has tried and won the Islamic Financial Institution (LKS) at the Review Level (PK) of the Lawsuit against the Law submitted by the guarantee owner to the LKS in the Court Negeri North Jakarta Number 732/Pdt.G/2018/PN.JKT.UTR, (North Jakarta District Court), the reason for the PMH lawsuit is that the Plaintiff has never guaranteed his land and building assets, but suddenly by the LKS burdened as a guarantee object Murabahak contract, so that the worksheet does not meet the principle of prudence banking (prudential banking) in providing financing to customers (partners).

That previously on January 28, 2020 North Jakarta District Court had issued Decision Number 732/Pdt.G/2018/PN.JKT.UTR, where the issuance of the decision was very detrimental to the LKS as a financial institution operating with sharia principles, because the panel of judges had dropped the verdict By stating that the Al Murabahah Financing Deed was null and void (neitig), then punished the worksheet to submit the certificate of guarantee object to the plaintiff.

The decision of the North Jakarta District Court which assessed that the enactment of the Sharia contract was clearly detrimental because it had deviated the guidelines in the procedural law of sharia economic dispute resolution, which confirmed that all sharia economic disputes became the authority of the judiciary in the environment of the Religious Courts. (Vide the Constitutional Court Decision Number 93/PUU-X/2012, Article 55 of the Sharia Banking Law and Perma No. 14 of 2016 concerning Procedures for Settlement of Sharia Economic Cases).

Furthermore, against the North Jakarta District Court's decision, the Sham & Partners Council as the power of the LKS immediately submitted an PK effort without appeal and cassation. PK efforts with register number 497 PK/Pdt/2021, which in the PK decision basically MA canceled decision number 732/Pdt.G/2018/PN.JKT.UTR on January 28, 2020, with the consideration that the lawsuit filed by other parties ( In addition to customers) on the grounds of an illegal act (PMH) must first have a criminal decision, and as long as it has not been proven to be a criminal act, the Sharia contract remains in force and binds to the parties, so that the District Court does not have absolute competencies.

That previously on January 28, 2020 North Jakarta District Court had issued Decision Number 732/Pdt.G/2018/PN.JKT.UTR, where the issuance of the decision was very detrimental to the LKS as a financial institution operating with sharia principles, because the panel of judges had dropped the verdict By stating that the Al Murabahah Financing Deed was null and void (neitig), then punished the worksheet to submit the certificate of guarantee object to the plaintiff.

The decision of the North Jakarta District Court which assessed that the enactment of the Sharia contract was clearly detrimental because it had deviated the guidelines in the procedural law of sharia economic dispute resolution, which confirmed that all sharia economic disputes became the authority of the judiciary in the environment of the Religious Courts. (Vide the Constitutional Court Decision Number 93/PUU-X/2012, Article 55 of the Sharia Banking Law and Perma No. 14 of 2016 concerning Procedures for Settlement of Sharia Economic Cases).

Furthermore, against the North Jakarta District Court's decision, the Sham & Partners Council as the power of the LKS immediately submitted an PK effort without appeal and cassation. PK efforts with register number 497 PK/Pdt/2021, which in the PK decision basically MA canceled decision number 732/Pdt.G/2018/PN.JKT.UTR on January 28, 2020, with the consideration that the lawsuit filed by other parties ( In addition to customers) on the grounds of an illegal act (PMH) must first have a criminal decision, and as long as it has not been proven to be a criminal act, the Sharia contract remains in force and binds to the parties, so that the District Court does not have absolute competencies.

#infographic: Istishna 'Parallel Banking Technical Scheme

#infographic: Istishna 'Parallel Banking Technical SchemeAssalamu'alaikum Warahmatullahi Wabarakatuh

The discussion this time about Istishna 'along with the banking technical scheme in Islamic economics.

Istishna 'According to the Fatwa of the National Sharia Council Number 06/DSN-MUI/IV/2000 dated April 4, 2000 concerning buying and selling istishna' which is a sale and purchase agreement in the form of ordering certain goods with certain criteria and requirements agreed between the customer (buyer, musttashni ' ) and seller (maker, Shani ').

The following is also conveyed about the istishna 'parallel scheme in banking technical in the form of infographic that can be downloaded by clicking the' Download here 'button at the bottom of the article.

Hopefully it will increase the knowledge of sharia partners, keep the spirit and be healthy always and hopefully today we are all given a blessing by Allah SWT.

Wassalamualaikum warahmatullahi wabarakatuh

#kitaperlutahu #advokatsyariah #advokatmasakini #legalshariapartner

The discussion this time about Istishna 'along with the banking technical scheme in Islamic economics.

Istishna 'According to the Fatwa of the National Sharia Council Number 06/DSN-MUI/IV/2000 dated April 4, 2000 concerning buying and selling istishna' which is a sale and purchase agreement in the form of ordering certain goods with certain criteria and requirements agreed between the customer (buyer, musttashni ' ) and seller (maker, Shani ').

The following is also conveyed about the istishna 'parallel scheme in banking technical in the form of infographic that can be downloaded by clicking the' Download here 'button at the bottom of the article.

Hopefully it will increase the knowledge of sharia partners, keep the spirit and be healthy always and hopefully today we are all given a blessing by Allah SWT.

Wassalamualaikum warahmatullahi wabarakatuh

#kitaperlutahu #advokatsyariah #advokatmasakini #legalshariapartner

Dewan Syam & Partners gained the first rank in the Scientific Writing Competition of the Indonesian Curator and Management Association (AKPI) 2021

Dewan Syam & Partners gained the first rank in the Scientific Writing Competition of the Indonesian Curator and Management Association (AKPI) 2021 Alhamdulillah, one of the founders of the Dewan Syam & Partners Law Firm, Syamsul Huda, S.H., M.E. Successfully ranked first in the scientific writing competition organized by the Indonesian Curator and Management Association (AKPI) 2021 with the title: 'Legal Certainty in the Framework of Sharia Economy Development in Indonesia.'

Hopefully this achievement inspires sharia partners to also carve out achievements in their respective fields.

Hopefully this achievement inspires sharia partners to also carve out achievements in their respective fields.

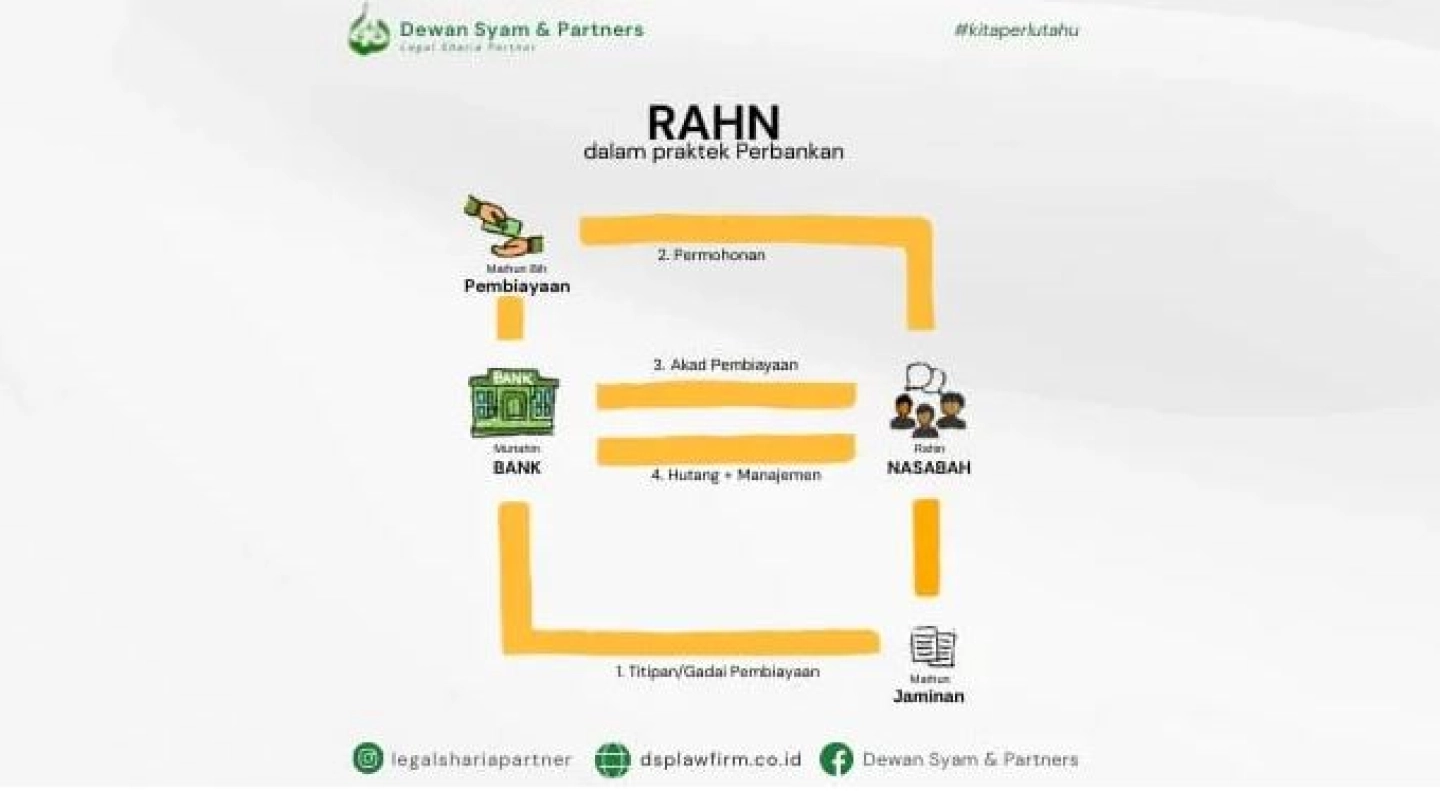

#infographic: Rahn scheme in banking practice

#infographic: Rahn scheme in banking practiceAssalamu'alaikum Warahmatullahi Wabarakatuh

The discussion this time is about Rahn along with the banking practice scheme in Islamic economics.

Rahn according to the Fatwa of the National Sharia Council Number 25/DSN-MUI/III/2002 dated June 26, 2002 concerning Rahn, which is to hold the goods as a guarantee of debt.

The following is also conveyed about the rahn scheme in banking practice in the form of infographic that can be downloaded by clicking the 'Download here' button at the bottom of the article.

Hopefully it will increase the knowledge of sharia partners, keep the spirit and be healthy always and hopefully today we are all given a blessing by Allah SWT.

Wassalamualaikum warahmatullahi wabarakatuh

#kitaperlutahu #advokatsyariah #advokatmasakini #legalshariapartner

The discussion this time is about Rahn along with the banking practice scheme in Islamic economics.

Rahn according to the Fatwa of the National Sharia Council Number 25/DSN-MUI/III/2002 dated June 26, 2002 concerning Rahn, which is to hold the goods as a guarantee of debt.

The following is also conveyed about the rahn scheme in banking practice in the form of infographic that can be downloaded by clicking the 'Download here' button at the bottom of the article.

Hopefully it will increase the knowledge of sharia partners, keep the spirit and be healthy always and hopefully today we are all given a blessing by Allah SWT.

Wassalamualaikum warahmatullahi wabarakatuh

#kitaperlutahu #advokatsyariah #advokatmasakini #legalshariapartner

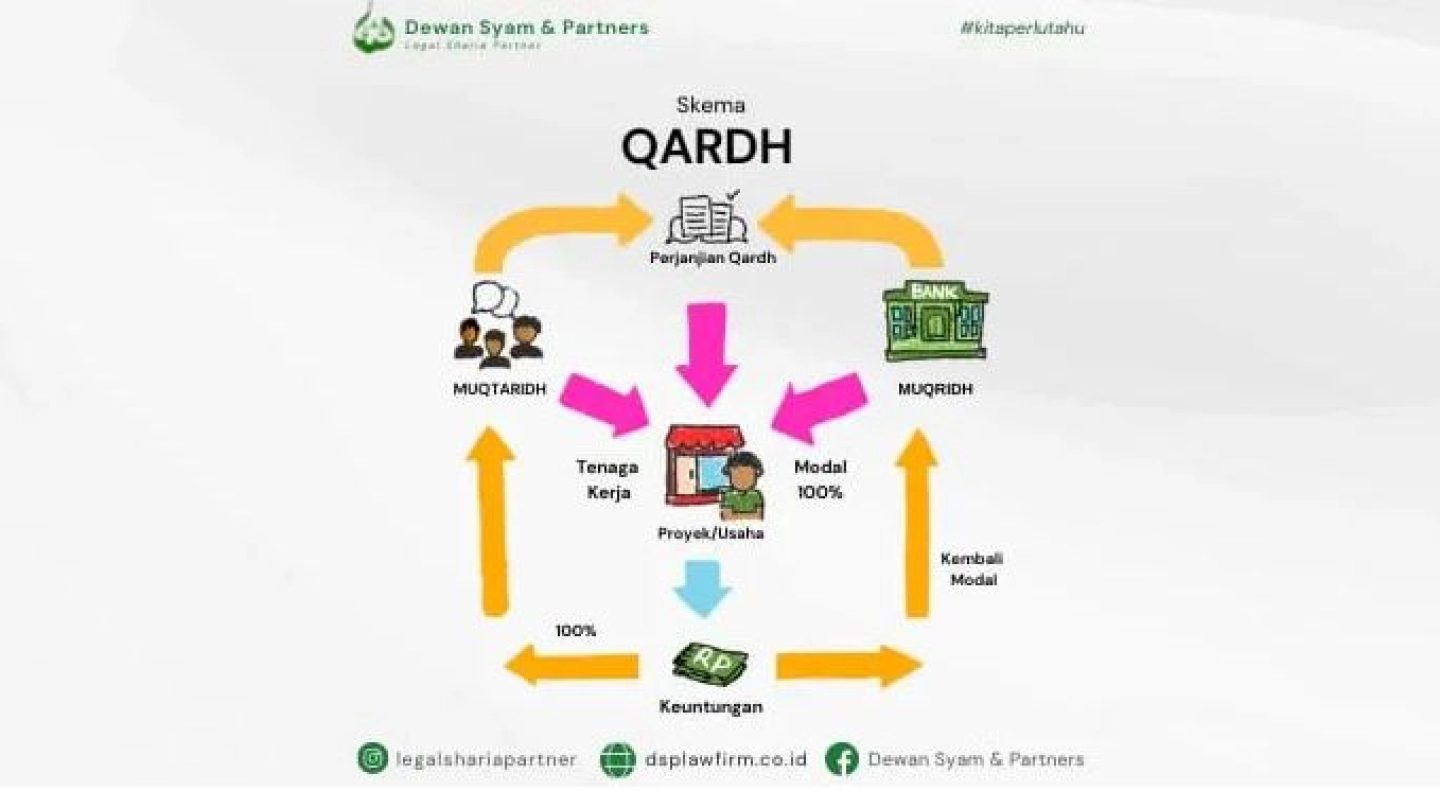

#infographic: Qardh Scheme

#infographic: Qardh Scheme Assalamu'alaikum Warahmatullahi Wabarakatuh

This discussion is about Qardh and schemes in Islamic economics.

Qardh according to the National Sharia Council Fatwa Number 19/DSN-MUI/IV/2001 dated April 18, 2001 concerning Al-Qardh is a loan contract to customers with the stipulation that the customer is obliged to return the funds received to the Sharia Financial Institution (LKS) at a time agreed upon by the LKS and the customer.

The following is also presented about the Qardh scheme in the form of an infographic which can be downloaded by clicking the 'download here' button at the bottom of the article.

Hopefully it will add to the knowledge of Sharia Partners, stay motivated and healthy always and hopefully today we are all blessed by Allah SWT.

Wassalamu'alaikum Warahmatullahi Wabarakatuh

#kitaperlutahu #advokatsyariah #advokatmasakini #legalshariapartner

This discussion is about Qardh and schemes in Islamic economics.

Qardh according to the National Sharia Council Fatwa Number 19/DSN-MUI/IV/2001 dated April 18, 2001 concerning Al-Qardh is a loan contract to customers with the stipulation that the customer is obliged to return the funds received to the Sharia Financial Institution (LKS) at a time agreed upon by the LKS and the customer.

The following is also presented about the Qardh scheme in the form of an infographic which can be downloaded by clicking the 'download here' button at the bottom of the article.

Hopefully it will add to the knowledge of Sharia Partners, stay motivated and healthy always and hopefully today we are all blessed by Allah SWT.

Wassalamu'alaikum Warahmatullahi Wabarakatuh

#kitaperlutahu #advokatsyariah #advokatmasakini #legalshariapartner